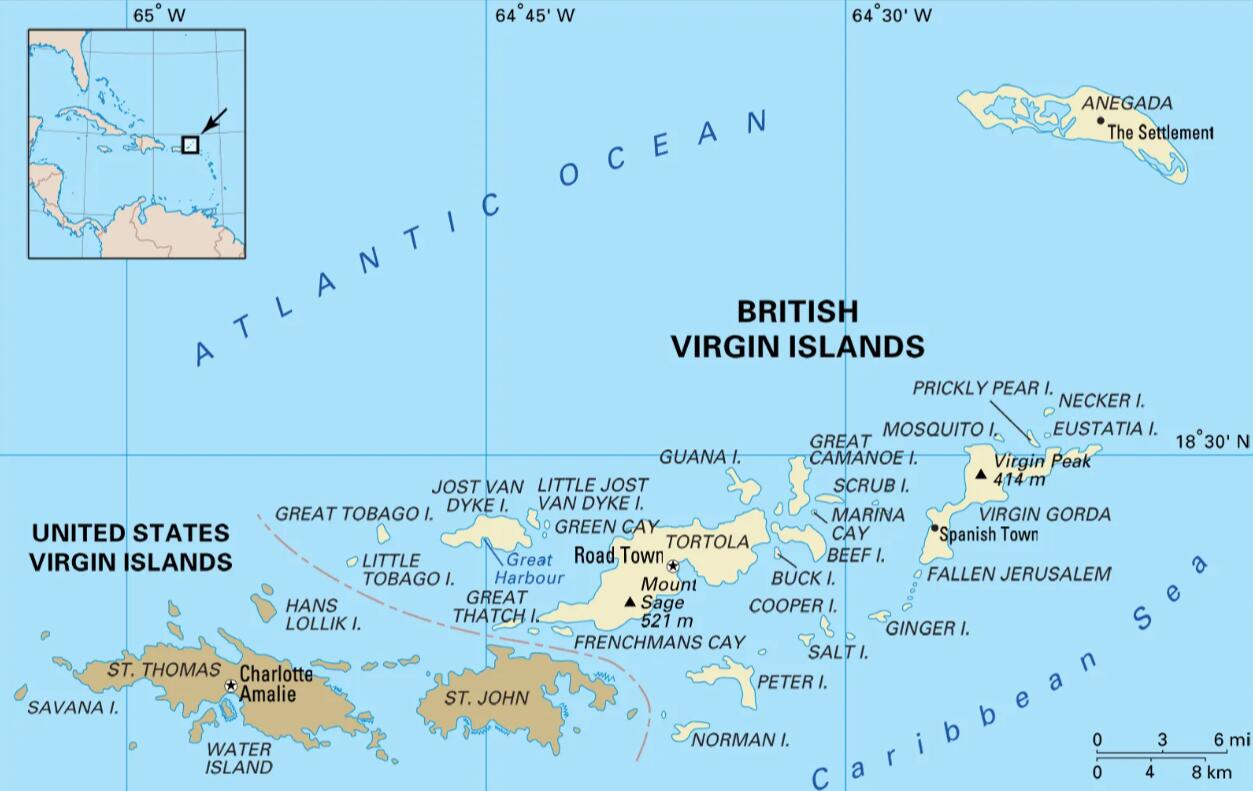

用BVI公司控股香港公司有什么好處?

0

眾所周知,BVI公司做為控股公司是完全免稅的,而且股東的信息是保密的,每年只需交一定的年費即可。

如果是投資內是,香港公司是許多走VEI通道的最后一層設置。香港最主要就是因為香港與內地有稅收優惠。08年新稅法實施以后,中國開始向外資企業征收20%的股息預提所得稅,一般減免下來也得10%左右。但對于港澳公司降低至5%。所以很多企業把最后一層架構設置在了香港。

假設BVI A公司持有香港公司的股權,現在你想把香港公司部分股權賣掉,那么需要在香港交印花稅。

再假設BVI A公司持有香港公司的股權,現在你想把香港公司的部分股權賣掉,那么你可以通過BVI公司來交易,轉讓BVI公司股權,這樣不用交印花稅。

如果是投資內是,香港公司是許多走VEI通道的最后一層設置。香港最主要就是因為香港與內地有稅收優惠。08年新稅法實施以后,中國開始向外資企業征收20%的股息預提所得稅,一般減免下來也得10%左右。但對于港澳公司降低至5%。所以很多企業把最后一層架構設置在了香港。

假設BVI A公司持有香港公司的股權,現在你想把香港公司部分股權賣掉,那么需要在香港交印花稅。

再假設BVI A公司持有香港公司的股權,現在你想把香港公司的部分股權賣掉,那么你可以通過BVI公司來交易,轉讓BVI公司股權,這樣不用交印花稅。

0

In a nutshell there are two kinds: One is "lifting the veil of corporation"; the other is providing direct regulations for the legal relationship between the parent company and subsidiaries through a specialized law of Group Corporation.

The main viewpoint of "lifting the veil of corporation" is as follows: as legal person, the company has independent legal personality and is independently liable for its legal actions and debts based on its total assets, while the company's shareholders only bear limited liability according to the amount of capital commitment, so the company's independent personality and limited liability of shareholders are just like a veil, which separates the shareholders from the company to protect shareholders from creditors recourse. However, shareholders are entitled the rights of the company's management because of investment, as its contribution reaches to a certain level, the shareholders will have the control power of the company, which may make shareholders use the control power to impose adverse impact on the company, and in many cases , the shareholders are most likely to use the company's personality to engage in various illegal acts and circumvent the law, which will result in damage to the creditors. Therefore, from the angle of maintaining social order and protecting the interests of creditors, in certain circumstances, the veil of corporation should be lifted to make shareholders be directly responsible for creditors. With the development of social life, the court comes to realize in practice that "the corporate veil" is often used by the company's shareholders to engage in various illegal acts, which often obscures the individual behaviors of shareholders and protects shareholders from creditors’ recourse, so in special circumstances the corporate veil should be lifted.

In cases of Giclford Motor Co., Ltd V. Horne l933 and Jones V. Lipman 1962, the court did not consider the company's independent personality, but ordered the company's shareholders to be responsible for creditors. In the case of Unit Construction Co Ltd V. Bull-cock l960, a British company has three companies registered in Kenya, although the articles of corporation confirm that the board of directors of each company should be held in Kenya, but in fact the three companies are entirely managed by holding company. The court held that registration in Kenya is indeed a fraud; the three companies should be domiciled in the UK, and should pay tax in the UK.

The main viewpoint of "lifting the veil of corporation" is as follows: as legal person, the company has independent legal personality and is independently liable for its legal actions and debts based on its total assets, while the company's shareholders only bear limited liability according to the amount of capital commitment, so the company's independent personality and limited liability of shareholders are just like a veil, which separates the shareholders from the company to protect shareholders from creditors recourse. However, shareholders are entitled the rights of the company's management because of investment, as its contribution reaches to a certain level, the shareholders will have the control power of the company, which may make shareholders use the control power to impose adverse impact on the company, and in many cases , the shareholders are most likely to use the company's personality to engage in various illegal acts and circumvent the law, which will result in damage to the creditors. Therefore, from the angle of maintaining social order and protecting the interests of creditors, in certain circumstances, the veil of corporation should be lifted to make shareholders be directly responsible for creditors. With the development of social life, the court comes to realize in practice that "the corporate veil" is often used by the company's shareholders to engage in various illegal acts, which often obscures the individual behaviors of shareholders and protects shareholders from creditors’ recourse, so in special circumstances the corporate veil should be lifted.

In cases of Giclford Motor Co., Ltd V. Horne l933 and Jones V. Lipman 1962, the court did not consider the company's independent personality, but ordered the company's shareholders to be responsible for creditors. In the case of Unit Construction Co Ltd V. Bull-cock l960, a British company has three companies registered in Kenya, although the articles of corporation confirm that the board of directors of each company should be held in Kenya, but in fact the three companies are entirely managed by holding company. The court held that registration in Kenya is indeed a fraud; the three companies should be domiciled in the UK, and should pay tax in the UK.